UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. _)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under § 240.14a-12

The Timken Company

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

PRELIMINARY COPY – SUBJECT TO COMPLETION

In accordance with Rule 14a-6(d) under Regulation 14A of the Securities Exchange Act of 1934, as amended, please be advised that The Timken Company intends to release definitive copies of this Proxy Statement to shareholders beginning on or about March 20, 2023.

| John M. Timken, Jr. The Timken Company

|

March 20, 2023

Dear Fellow Timken Shareholder:

Your Board of Directors is pleased to invite you to the 2023 Annual Meeting of Shareholders of The Timken Company to be held on Friday, May 5, 2023, at 10:00 a.m. local time. We will conduct this year’s meeting in an online-only format, with attendance via the internet.

This year, you are being asked to act upon six matters. Four of these matters (Proposals No. 1, 2, 4 and 5) have been unanimously recommended by your Board of Directors, while one of these matters (Proposal No. 6) is a shareholder proposal that is not supported by your Board of Directors. For the vote on “say-on-pay” frequency (Proposal No. 3), your Board of Directors recommends maintaining an annual say-on-pay vote. Details of these matters, along with the recommendations of your Board of Directors, are contained in the accompanying Notice of 2023 Annual Meeting of Shareholders and Proxy Statement.

Please read the enclosed information carefully before voting your shares. Voting your shares as soon as possible will ensure your representation at the meeting, whether or not you plan to attend.

I want to thank you for your continuous support of our business over the years and I look forward to strong participation and a similar vote of support at the 2023 Annual Meeting of Shareholders.

Sincerely,

John M. Timken, Jr.

Chairman – Board of Directors

Engineered Bearings I Mechanical Power Transmission Products I Industrial Services

THE TIMKEN COMPANY

North Canton, Ohio

_____________________

NOTICE OF 2023 ANNUAL MEETING OF SHAREHOLDERS

The 2023 Annual Meeting of Shareholders of The Timken Company will be held on Friday, May 5, 2023, at 10:00 a.m. local time, in an online-only format, with attendance via the internet at the following web address: www.cesonlineservices.com/tkr23_vm. You will not be able to attend this meeting in person.

The meeting is being held for the following purposes:

| 1. | Election of 11 Directors to serve for a term of one year; |

| 2. | Approval, on an advisory basis, of our named executive officer compensation; |

| 3. | Recommendation, on an advisory basis, of the frequency (every 1, 2 or 3 years) of the shareholder advisory vote on named executive officer compensation; |

| 4. | Ratification of the appointment of Ernst & Young LLP as our independent auditor for the fiscal year ending December 31, 2023; |

| 5. | Approval of amendments to our Amended Articles of Incorporation and Amended Regulations to reduce certain shareholder voting requirement thresholds; |

| 6. | Consideration of a shareholder proposal requesting our Board of Directors to take the steps necessary to amend the appropriate company governing documents to give the owners of a combined 10% of our outstanding common stock the power to call a special shareholder meeting; and |

| 7. | Consideration of such other business as may properly come before the meeting. |

Shareholders of record of common shares of The Timken Company at the close of business on February 21, 2023 are the shareholders entitled to notice of and to vote at the meeting.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO PARTICIPATE IN THE ONLINE-ONLY 2023 ANNUAL MEETING OF SHAREHOLDERS, PLEASE SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT IN THE POSTAGE-PAID ENVELOPE PROVIDED OR VOTE YOUR SHARES ELECTRONICALLY THROUGH THE INTERNET OR BY TELEPHONE. VOTING INSTRUCTIONS ARE PROVIDED ON THE ENCLOSED PROXY CARD.

Effect of Not Casting Your Vote. Under New York Stock Exchange (“NYSE”) rules, if you hold your shares in “street name” through a brokerage account, your broker will NOT be able to vote your shares for you on most of the matters being considered at the 2023 Annual Meeting of Shareholders, including the election of Directors, unless you have given instructions to your broker prior to the meeting.

In order to attend the online-only meeting, you will need to pre-register by 10:00 a.m. Eastern Time on May 4, 2023. To pre-register for the meeting, please follow these instructions:

Registered Shareholders

If your shares are registered in your name with our transfer agent or you are a participant holding shares in a Timken-sponsored employee savings plan and you wish to attend the virtual meeting, go to www.cesonlineservices.com/tkr23_vm. Please have your Proxy Card or Notice of the Meeting, containing your 11-digit control number available and follow the instructions to complete your registration request.

Beneficial Shareholders (those holding shares through a stock brokerage account or by a bank or other holder of record)

Beneficial shareholders who wish to attend the virtual meeting may pre-register by visiting the website www.cesonlineservices.com/tkr23_vm. Please have available the voting instruction form, notice, or other communication from your broker, bank, or other holder of record that sets forth the control number provided to you and follow the instructions to complete your registration request.

After pre-registering for the meeting, shareholders will receive a confirmation email with a link and instructions for accessing the virtual Annual Meeting and submitting questions. Shareholders may review the rules of conduct for the virtual meeting or vote during the virtual Annual Meeting by following the instructions available on the meeting website.

Thank you for your continued support of The Timken Company.

| Hansal N. Patel | |

| Vice President, General Counsel & Secretary |

March 20, 2023

Important Notice Regarding the Availability of Proxy Materials for the 2023 Annual Meeting of Shareholders to be held on May 5, 2023: This Proxy Statement and our 2022 Annual Report to Shareholders are available on the Investors section of our website https://investors.timken.com/.

TABLE OF CONTENTS

PROXY SUMMARY

This summary highlights certain information contained in the Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement before voting.

2023 Annual Meeting of Shareholders

| Date and Time: | Friday, May 5, 2023, at 10:00 a.m. local time | |

| Location: | Online-only format, with attendance via the internet at the following web address: www.cesonlineservices.com/tkr23_vm | |

| Record Date: | February 21, 2023 | |

| Mail Date: | The approximate date our Proxy Statement and proxy card will be first sent or given to our shareholders is March 20, 2023. |

Voting Matters and Board Voting Recommendations

| Board Recommends | Proposal | See Page | |

| For | 1. | Election of 11 Directors to serve for a term of one year. | 12 |

| For | 2. | Approval, on an advisory basis, of our named executive officer compensation. | 33 |

| Every Year | 3. | Recommendation, on an advisory basis, of the frequency (every 1, 2 or 3 years) of the shareholder advisory vote on named executive officer compensation. | 80 |

| For | 4. | Ratification of the appointment of Ernst & Young LLP as our independent auditor for the fiscal year ending December 31, 2023. | 81 |

| For | 5. | Approval of amendments to our Amended Articles of Incorporation and Amended Regulations to reduce certain shareholder voting requirement thresholds. | 83 |

| Against | 6. | A shareholder proposal requesting our Board to take the steps necessary to amend the appropriate company governing documents to give the owners of a combined 10% of our outstanding common stock the power to call a special shareholder meeting. | 84 |

| 1 |

Director Nominees

See Proposal No. 1 on page 12 of the Proxy Statement for more details on the 11 nominees for Director. The following information describes relevant information about each nominee as of March 1, 2023.

| Committee Memberships | Committee Memberships | |||||||||||||||||||||||||||

| Name and Title | Age | Director since | Independent | Audit | Compensation | Nominating & Corporate Governance | Other Public Boards | Age | Director since | Independent | Audit | Compensation | Nominating & Corporate Governance | Other Public Boards | ||||||||||||||

| Maria A. Crowe Retired President of Manufacturing Operations, Eli Lilly and Company | 63 | 2014 | ü | ü | ü Chair | _ | 63 | 2014 | ü | ü | ü Chair | _ | ||||||||||||||||

| Elizabeth A. Harrell Retired Major General, U.S. Air Force | 69 | 2017 | ü | ü | ü | _ | 69 | 2017 | ü | ü | ü | _ | ||||||||||||||||

| Richard G. Kyle President and Chief Executive Officer, The Timken Company | 57 | 2013 | 1 | 57 | 2013 | 1 | ||||||||||||||||||||||

| Sarah C. Lauber Chief Financial Officer & Secretary, Douglas Dynamics, Inc. | 51 | 2021 | ü | ü | ü | _ | ||||||||||||||||||||||

| Sarah C. Lauber Executive Vice President, CFO and Secretary, Douglas Dynamics, Inc. | 51 | 2021 | ü | ü | ü | _ | ||||||||||||||||||||||

| John A. Luke, Jr. Retired Chairman, WestRock Company; Retired President and CEO MeadWestvaco Corporation | 74 | 1999 | ü | ü | ü | _ | 74 | 1999 | ü | ü | ü | _ | ||||||||||||||||

| Christopher L. Mapes Chairman, President and Chief Executive Officer, Lincoln Electric Holdings, Inc. | 61 | 2014 | ü | ü | ü | 1 | 61 | 2014 | ü | ü | ü | 1 | ||||||||||||||||

| James F. Palmer Retired Corporate Vice President and Chief Financial Officer, Northrop Grumman Corporation | 73 | 2015 | ü | ü Chair | ü | _ | 73 | 2015 | ü | ü Chair | ü | _ | ||||||||||||||||

| Ajita G. Rajendra Retired Executive Chairman, President and CEO A. O. Smith Corporation | 71 | 2014 | ü | ü | ü Chair | 2 | 71 | 2014 | ü | ü | ü Chair | 2 | ||||||||||||||||

| Frank C. Sullivan Chairman and Chief Executive Officer, RPM International Inc. | 62 | 2003 | ü | ü | ü | 1 | 62 | 2003 | ü | ü | ü | 1 | ||||||||||||||||

| John M. Timken, Jr. Chairman, Board of Directors, The Timken Company | 71 | 1986 | ü Independent Chairman | _ | 71 | 1986 | ü Independent Chairman | _ | ||||||||||||||||||||

Ward J. Timken, Jr. Chief Executive Officer, McKinley Strategies, LLC | 55 | 2002 | _ | 55 | 2002 | _ | ||||||||||||||||||||||

| Average Age / Median Tenure | 64 | 9 years | 64 | 9 years | ||||||||||||||||||||||||

| 2 |

Current Board Composition Overview

| Gender and Ethnic Diversity | Independence |

|  |

| Leadership | Refreshment |

| 2/3 | Half |

| of Committee Chairs are ethnically or gender diverse | of our Board refreshed within the last decade |

| 3 |

Representative Skills and Attributes of the Board

| 4 |

Corporate Governance Highlights

The Timken Company is committed to strong corporate governance as evidenced by the following practices. See page 25 of the Proxy Statement for more details.

| Board Independence | ü | 10 of 12 current Directors are independent |

| ü | Independent Chair of the Board | |

| Director Elections | ü | Commitment to Board refreshment and diversity – 6 new Directors (representing half of our current Board) added in the past decade |

| ü | 2 of 3 of the committee chairs are ethnically or gender diverse | |

| ü | All committee members are independent | |

| ü | Declassified Board with annual Board elections | |

| ü | Directors are elected by a majority of votes cast, and our Majority Voting Policy requires any Director who fails to receive a majority of the votes cast in favor of his or her election to submit his or her resignation to the Board | |

| Board Practices | ü | Stock ownership requirements for nonemployee Directors (5x cash retainer) |

| ü | At each Board meeting, the independent Directors have the opportunity to conduct executive sessions | |

| ü | Annual Board, committee and Director evaluations | |

| ü | Over-boarding policy limits the number of public company boards a Director can serve on | |

| Shareholder Rights | ü | Shareholder proxy access with 3/3/20/20 parameters |

| ü | Special meetings may be called by shareholders holding 25% of the Company’s common shares | |

| Other Best Practices | ü | Annual advisory vote on our named executive officer compensation with consistently strong shareholder support over the past five years |

| ü | 5 of 12 current Directors are ethnically or gender diverse | |

| ü | Code of Conduct for Directors, officers and employees | |

| ü | Strong focus on shareholder engagement – over 400 interactions with investors in 2022 | |

| ü | Audit Committee or Board receives reports on cyber security threats and trends at least annually and receives regular updates on our information security program | |

| ü | Nominating and Corporate Governance Committee provides oversight for Corporate Social Responsibility (“CSR”) program |

| 5 |

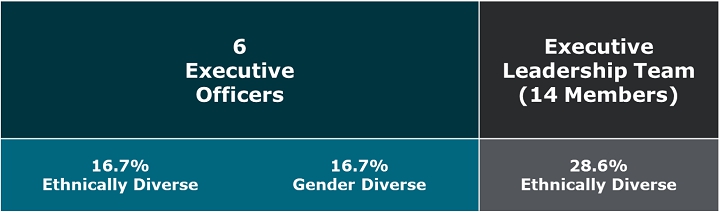

Executive Leadership Diversity

Corporate Social Responsibility

At Timken, we continue to explore and develop new and better solutions for our customers’ most challenging problems. This is also how we approach CSR and the goals and initiatives we choose to support. In 2022, CSR remained a priority for Timken as we formalized our product sustainability initiatives, set emissions reduction targets, and continued to advance our human capital, community engagement, and charitable giving efforts. In consideration of our efforts, we were named one of America’s Most Responsible Companies by Newsweek and Statista for the second time.

Throughout 2022, we continued to pursue greater sustainability across our product portfolio through product design, lifetime performance improvements, and use of recyclable content.

For more information regarding our corporate social responsibility program, please see page 25 of the Proxy Statement or our most recent corporate social responsibility report available on our website at https://www.timken.com/corporate-social-responsibility/.

Other recent awards include:

| ● | Forbes: America’s Best Employers (2021), Best Employers for New Graduates (2021 and 2022) and Best Employers for Women (2021); and | |

| ● | The Ethisphere Institute: World’s Most Ethical Companies® (2021 and awarded 11 times total). |

| 6 |

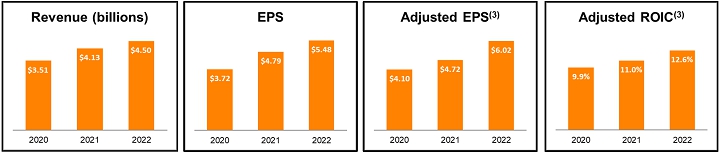

2022 Performance Highlights

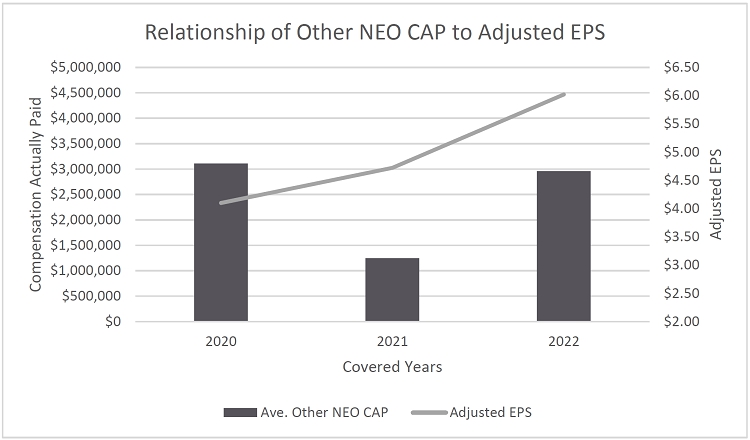

In 2022, Timken continued to advance its position as a diversified industrial leader and delivered a second consecutive year of record performance. The Company grew revenue and earnings significantly in 2022, with revenue increasing approximately 9% from 2021 to a record $4.5 billion, net income increasing approximately 10% to $407 million and adjusted earnings before interest, taxes, depreciation, and amortization (“EBITDA”) increasing approximately 19% to $856 million1. We achieved record earnings per diluted share (“EPS”) of $5.48 and record adjusted EPS of $6.021, up approximately 14% and 28%, respectively, from 2021. We also delivered an adjusted return on invested capital (“ROIC”) of 12.6%1 in 2022, up from 11.0% last year. In addition, we generated net cash from operations of $464 million and free cash flow of $2851 million in 2022. Beginning in 2023, the Company will make certain changes in its methodology for computing and reporting adjusted EPS and adjusted ROIC. See page 40 for more details regarding this methodology change.

We achieved these results in a highly dynamic operating environment by continuing to execute our profitable growth strategy, which is delivering strong performance and returns through the industrial cycle. Our proven strategy focuses on (1) driving organic growth and market share gains in our core business by leading in product technology, innovation and service, (2) advancing operational excellence initiatives across the enterprise to enhance performance and expand margins, and (3) deploying capital to drive optimal returns for our investors.

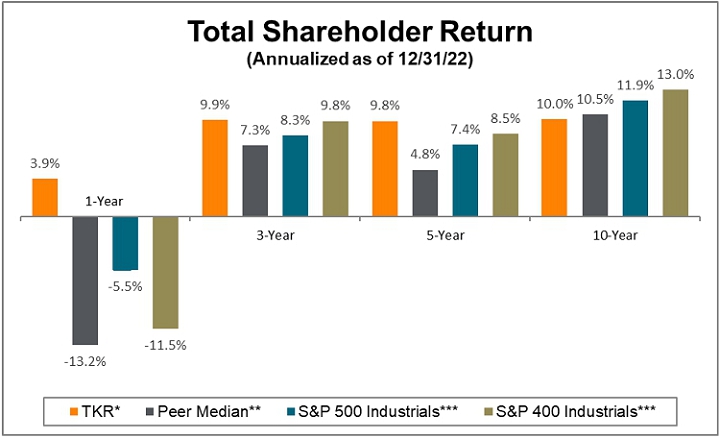

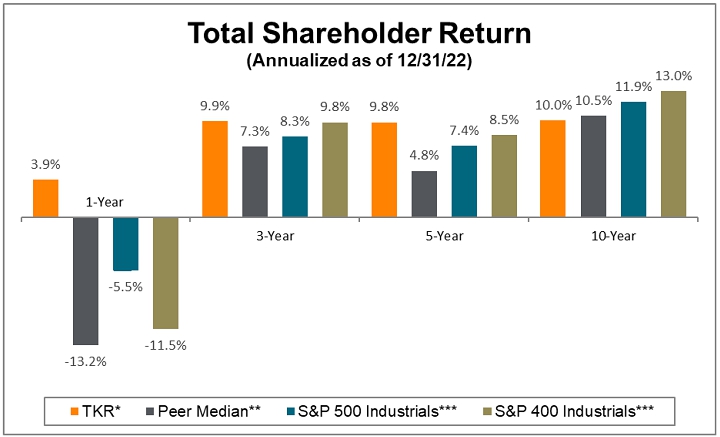

We have continued to create significant shareholder value by delivering total shareholder returns (“TSR”) of 3.9%, 9.9%, 9.8%, and 10.0% over the past one-, three-, five-, and ten-year periods, respectively. Our TSR for each of the one-, three-, and five-year periods outpaced the median of our 2022 compensation peer group2, the S&P 500 Industrials and the S&P 400 Industrials. The S&P 500 Industrials comprises those companies included in the S&P 500 index that are classified as members of the Global Industry Classification Standard (“GICS”) industrials sector, while the S&P 400 Industrials comprises those companies included in the S&P MidCap 400 that are classified as members of the GICS industrials sector.

In 2022, we deployed capital in a disciplined and balanced manner to strengthen our business, enhance our financial returns and create value for our shareholders. We allocated $178 million, or about 4.0% of our sales, to capital expenditures focused on growth and operational improvement initiatives. We paid out our 402nd consecutive quarterly dividend, continuing one of the longest continuous dividend streaks on the NYSE, and increased our quarterly dividend to $0.31 per share in the second quarter, making 2022 the ninth consecutive year of annual dividend growth. We repurchased approximately 3.25 million shares of stock, or over 4% of our outstanding shares. And finally, we strengthened our engineered bearings and industrial motion product portfolios by allocating approximately $453.7 million toward two strategic acquisitions (Spinea, a technology leader and manufacturer of highly engineered cycloidal reduction gears and actuators; and GGB Bearings, a global supplier of premium, highly engineered and customized plain bearings and metal-polymer bearings). Both acquisitions offer significant synergy opportunities and increase our position in attractive market sectors.

2022 also marked the release of our latest annual CSR report, which detailed how we create and evaluate product sustainability across our portfolio and how we innovate with our customers to advance their CSR commitments.

See page 35 of the Proxy Statement for more details on the Company’s 2022 performance.

1 See Appendix A for reconciliations of adjusted EPS, adjusted EBITDA, free cash flow, and adjusted ROIC to their most directly comparable GAAP financial measures. Free cash flow is defined as net cash from operations minus capital expenditures. Adjusted ROIC is defined as adjusted net operating profit after taxes (“ANOPAT”) divided by average invested capital. The performance metrics discussed above are used for external reporting purposes and may not correlate exactly to their corresponding compensation metrics due to slight differences in methodology (see pages 48 to 52 for more details on how the compensation metrics are calculated).

2 Excludes Meritor, Inc. since it is no longer a standalone public company after being acquired by Cummins Inc. during 2022.

| 7 |

Return to Shareholders

*TSR for the Company was calculated on an annualized basis and assumes quarterly reinvestment of dividends. The 10-year period takes into account the value of TimkenSteel Corporation (“TimkenSteel”) common shares distributed in the spinoff of TimkenSteel from the Company, which was completed on June 30, 2014 (the “Spinoff”).

**See page 43 of the Proxy Statement for the companies that are included in the compensation peer group for 2022. The Peer Median excludes Meritor, Inc. since it is no longer a standalone public company after being acquired by Cummins Inc. during 2022.

***The S&P 500 Industrials and S&P 400 Industrials comprise those companies that are classified as members of the GICS industrials sector included in the S&P 500 index and S&P MidCap 400 index, respectively.

| 8 |

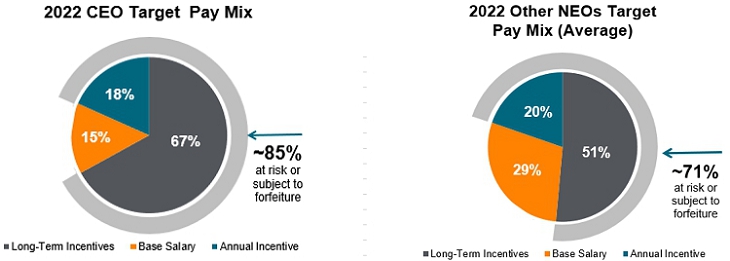

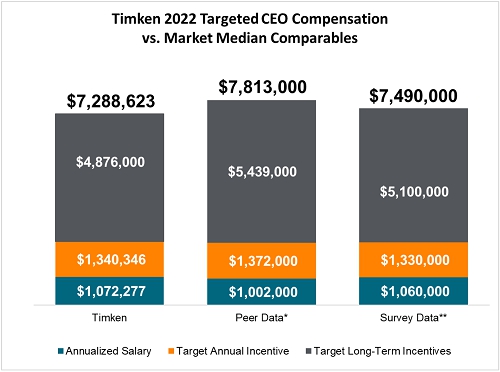

2022 Executive Compensation Practices

We design our executive compensation plans and program to help us attract, motivate, reward and retain highly qualified executives who are capable of creating and sustaining value for our shareholders over the long term. See page 35 of the Proxy Statement for more details.

| Objectives | Philosophy |

Our executive compensation program is designed to: ● Align the interests of our executives and shareholders ● Reward sustained, strong business results ● Incentivize profitable growth and capital deployment discipline ● Attract, retain and motivate the best talent | Our executive compensation philosophy is built on the following principles: ● Recognizing that people are our most important resource ● Rewarding results linked to both short- and long-term performance (pay-for-performance) ● Positioning our pay to be competitive in the marketplace ● Focusing on increasing shareholder value |

| What We Do | What We Do Not Do | ||

| We utilize stock ownership requirements for executives (7x base salary for CEO and 2x-3x for the other named executive officers) |  | We do not re-price outstanding stock options |

| We have “clawback” provisions that permit the recovery of executive compensation if an executive engages in conduct that is detrimental to the Company and results in restatement of financial results |  | We do not provide excise tax gross-ups on perquisites or under named executive officer severance agreements |

| We use shareholder-approved plans to provide short-term and long-term incentives |  | We do not allow hedging or pledging of our shares |

| We use different metrics for short-term and long-term incentive plans that are designed to align pay with performance |  | We do not have single-trigger vesting |

| We provide very limited perquisites |  | We do not have employment agreements for our named executive officers |

| 9 |

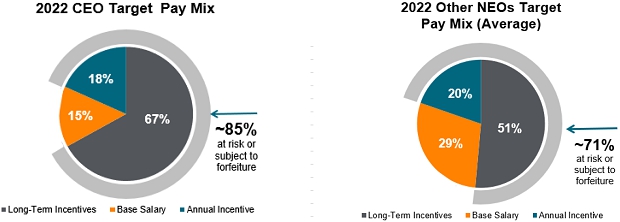

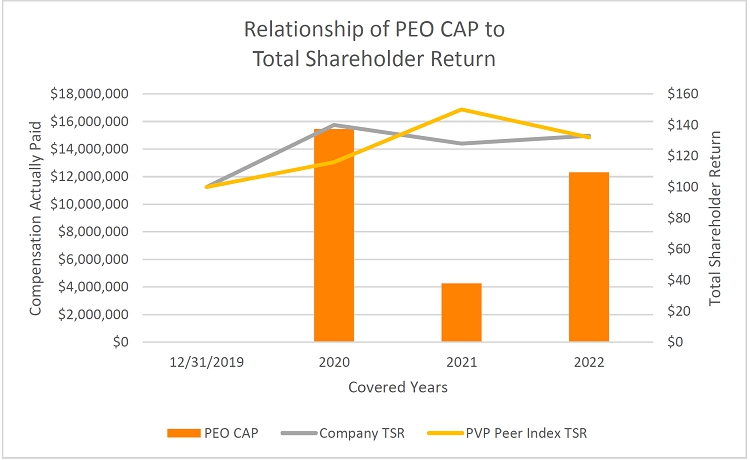

Pay-for-Performance

Our executive compensation program is designed to link pay and performance. We have received a strong level of shareholder support for our named executive officer compensation program through our annual “say-on-pay” vote over the last few years (as depicted below). A significant portion of the compensation of our named executive officers is equity based, which we believe aligns our executives’ interests with the interests of our shareholders.

The Company’s executive compensation program is designed to link compensation with key financial and operational goals of the Company, some of which are short-term, while others take several years or more to achieve. The Company uses a balance of short-term and long-term incentives, as well as cash and non-cash compensation, to meet these objectives:

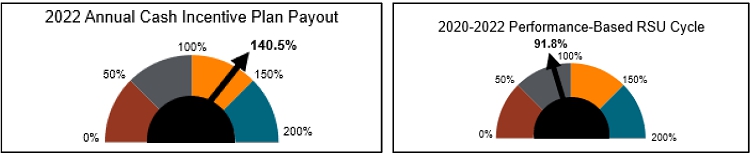

Our incentive compensation program payouts for performance periods ending in 2022 reflect strong performance relative to a challenging cost and supply chain situation:

| ● | There was a 140.5% payout under the annual cash incentive plan, which reflected above-target performance for 2022, due primarily to strong revenue growth, higher pricing and solid operational execution, which more than offset the impact of continued cost and supply chain-related headwinds across the enterprise; and | |

| ● | There was a 91.8% payout for 2020-2022 performance-based restricted stock units, which reflected strong overall performance in a dynamic environment. While 2020 results were adversely impacted by the COVID-19 pandemic, we then achieved record adjusted EPS results in 2021 and 2022, and strong average adjusted ROIC performance over the period. |

| 10 |

See pages 48 to 52 of the Proxy Statement for more details on the 2022 annual cash incentive plan and the 2020-2022 performance-based restricted stock units.

| 11 |

THE TIMKEN COMPANY

PROXY STATEMENT

The enclosed proxy is solicited by the Board of Directors (also referred to as the “Board”) of The Timken Company, an Ohio corporation (the “Company,” “Timken,” “we,” or “us”), in connection with the 2023 Annual Meeting of Shareholders to be held on Friday, May 5, 2023, at 10:00 a.m. local time in an online-only format, with attendance via the internet, and at any adjournments and postponements thereof, for the purpose of considering and acting upon the matters specified in the foregoing Notice.

The approximate date this Proxy Statement and proxy card will be first sent or given to our shareholders is March 20, 2023.

Instructions for attending the online-only meeting are available in the accompanying Notice of 2023 Annual Meeting of Shareholders and under the section titled “Participation at the Annual Meeting” on page 88.

The Board of Directors is not aware of matters other than those specified in the foregoing Notice that will be brought before the meeting for action. However, if any such matters should be properly brought before the meeting, the persons appointed as proxies may vote or act upon such matters according to their judgment.

PROPOSAL NO. 1: ELECTION OF DIRECTORS

We currently have 12 Directors. Pursuant to our Amended Regulations, all nominees for Director will stand for election for a one-year term to expire at the 2024 Annual Meeting of Shareholders. Candidates for Director receiving the greatest number of votes will be elected. Abstentions and “broker non-votes” (where a broker, other record holder, or nominee indicates on a proxy card that it does not have authority to vote certain shares on a particular matter) will not be counted in the election of Directors and will not have any effect on the result of the vote.

Pursuant to the Majority Voting Policy of the Board of Directors, any Director who fails to receive a majority of the votes cast in his or her election will submit his or her resignation to the Board of Directors promptly after the certification of the election results. The Board of Directors and the Nominating and Corporate Governance Committee will then consider the resignation in light of any factors they consider appropriate, including the Director’s qualifications and service record, as well as any reasons given by shareholders as to why they withheld votes from the Director. The Board of Directors is required to determine whether to accept or reject the tendered resignation within 90 days following the election and to disclose on a Current Report on Form 8-K its decision, as well as the reasons for rejecting any tendered resignation, if applicable.

Jacqueline F. Woods, a Director of the Company since 2000, is retiring from the Board effective as of the 2023 Annual Meeting of Shareholders. In connection with Ms. Woods’ retirement, at its meeting on February 10, 2023, the Board approved a resolution decreasing the size of the Board from 12 to 11 Directors effective as of the 2023 Annual Meeting of Shareholders. We thank Ms. Woods for her significant contributions to the Company during her service on the Board.

At its meeting on February 10, 2023, the Board also approved a resolution, based on the recommendation of the Nominating and Corporate Governance Committee, nominating the 11 individuals set forth below to be elected Directors at the 2023 Annual Meeting of Shareholders to serve for a term of one year expiring at the 2024 Annual Meeting of Shareholders (or until their respective successors are elected and qualified). Each of the nominees previously was elected as a Director by our shareholders and each has consented to serve as a Director if elected.

| 12 |

If any nominee becomes unable, for any reason, to serve as a Director, or should a vacancy occur before the election (which events are not anticipated), the Directors then in office may substitute another person as a nominee or may reduce the number of nominees as they deem advisable. Unless otherwise indicated on any proxy card, the persons named as proxies on the enclosed proxy card intend to vote the shares covered by such proxy card in favor of the nominees below.

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THE FOLLOWING NOMINEES. |

Nominees

The following information, obtained in part from the respective nominee and in part from our records, describes the background and select experience of each nominee as of March 1, 2023:

Maria A. Crowe Age: 63 Director since 2014 Committees: ● Audit ● Nominating and Corporate Governance (Chair) | Business Experience Ms. Crowe served as President of Manufacturing Operations for Eli Lilly and Company, a global manufacturer of pharmaceutical products, a position she held from 2012 until her retirement in December 2017. Ms. Crowe joined Eli Lilly and Company in 1982, and previously served as its Senior Vice President of Global Drug Products from 2009 to 2012. Qualifications Ms. Crowe provides the Board with extensive experience in manufacturing, sourcing and procurement for a global manufacturing company. Ms. Crowe also brings valuable experience on production capacity expansion and innovation efforts. | |

Elizabeth A. Harrell Age: 69 Director since 2017 Committees: ● Compensation ● Nominating and Corporate Governance | Business Experience Ms. Harrell retired as a Major General in October 2006, serving more than 30 years with the U.S. Air Force. After her retirement from the U.S. Air Force, Ms. Harrell was a consultant with The Spectrum Group until 2009 and a consultant to Northrop Grumman Corporation, a global security company and a provider of products, systems and solutions in the fields of aerospace, electronics, information systems, and technical services, until 2012. Qualifications Ms. Harrell’s extensive knowledge of aerospace technology, global supply chain management and government relations align with the Company’s growth priorities and are valuable to her service as a member of the Board. |

Richard G. Kyle Age: 57 Director since 2013 | Business Experience Mr. Kyle was appointed President and Chief Executive Officer of The Timken Company in 2014. Mr. Kyle joined the Company in 2006 and has served in multiple leadership roles of increasing responsibility during his tenure with the Company. Since 2015, Mr. Kyle has served as a director of Sonoco Products Company, a global provider of consumer packaging, industrial products, protective solutions, and display and packaging services, and as a member of its Audit, Executive Compensation and Governance and Nominating Committees. Qualifications Mr. Kyle has significant experience with global manufacturing organizations and has demonstrated the ability to lead change and growth. In addition to his role as Chief Executive Officer of the Company, Mr. Kyle’s strong engineering and operational background, coupled with his strategic perspective, provide valued skills to the Board. | |

Sarah C. Lauber Age: 51 Director since 2021 Committees: ● Audit ● Compensation | Business Experience Ms. Lauber is Qualifications Ms. Lauber’s expertise leading the finance and accounting function of multiple publicly traded manufacturing companies and her experience with financial planning and acquisition integration makes her well-suited to serve on our Board. |

John A. Luke, Jr. Age: 74 Director since 1999 Committees: ● ��Compensation ● Nominating and Corporate Governance | Business Experience Mr. Luke served as the Chairman and Chief Executive Officer of MeadWestvaco Corporation, a leading global producer of packaging and specialty chemicals, from the merger of Mead and Westvaco in 2002 until his retirement in 2015. Mr. Luke served as a director of WestRock Company from 2015 until 2022 when he retired as its Non-Executive Chairman. Mr. Luke previously served as a director of The Bank of New York Mellon Corporation from 2007 to 2018 and Dominion Midstream GP, LLC from 2017 to 2018. Qualifications Mr. Luke brings deep executive leadership experience to our Board, including expertise in leading large corporate transformations and evaluating and executing inorganic growth opportunities. Mr. Luke brings perspective gained from serving on several corporate boards. | |

Christopher L. Mapes Age: 61 Director since 2014 Committees: ● Audit ● Nominating and Corporate Governance | Business Experience Mr. Mapes is Chairman, President and Chief Executive Officer of Lincoln Electric Holdings, Inc., a global manufacturer of welding, cutting and joining products. He has held the position of Chairman since December 2013 and has been President and Chief Executive Officer since December 2012, after serving as Chief Operating Officer beginning in 2011. Mr. Mapes has been a director of Lincoln Electric Holdings, Inc. since 2010. Qualifications As a seasoned executive with extensive experience leading global manufacturing and distribution companies, Mr. Mapes understands the challenges of global growth and the complexity of managing international operations. In addition to his business management experience, Mr. Mapes has a law degree. |

James F. Palmer Age: 73 Director since 2015 Committees: ● Audit (Chair) ● Compensation | Business Experience Mr. Palmer served as the Corporate Vice President and Chief Financial Officer of Northrop Grumman Corporation, a global security company and a provider of products, systems and solutions in the fields of aerospace, electronics, information systems and technical services, from March 2007 until February 2015 and as a Corporate Vice President of Northrop Grumman until his retirement in July 2015. Qualifications Mr. Palmer’s broad executive background in the aerospace and defense industry, his service as the chief financial officer of multiple large publicly traded companies, and his extensive experience with business acquisitions, debt financings and other complex transactions make him well qualified to serve as a member of the Board. | |

Ajita G. Rajendra Age: 71 Director since 2014 Committees: ● Audit ● Compensation (Chair) | Business Experience Mr. Rajendra served as Executive Chairman of A. O. Smith Corporation, a global water technology company and manufacturer of residential and commercial water heating and water purification equipment, from September 2018 until his retirement on May 1, 2020. He had held the position of Chairman since 2014 and was President and Chief Executive Officer from 2013 until 2018. Qualifications Mr. Rajendra has been a director of A. O. Smith Corporation since 2011 and has been a director of Donaldson Company, Inc. since 2010, where he is a member of the Corporate Governance Committee and Human Resources Committee. Mr. Rajendra’s extensive manufacturing and international experience leading businesses and negotiating acquisitions and joint ventures, along with his experience as a director of other publicly traded companies, provides valuable skills to the Board. |

Frank C. Sullivan Age: 62 Director since 2003 Committees: ● Compensation ● Nominating and Corporate Governance | Business Experience Mr. Sullivan has held the position of Chairman and Chief Executive Officer of RPM International Inc. (“RPM”), a world leader in specialty coatings, since 2008. Mr. Sullivan was appointed RPM’s Chief Executive Officer in 2002, prior to which he held the position of Chief Financial Officer since 1993. Mr. Sullivan has been a director of RPM since 1995 and chairs RPM’s Executive Committee. Qualifications Mr. Sullivan provides the Board with extensive financial expertise based on his years as a chief financial officer. In addition, as a chief executive officer and director of a multinational company, Mr. Sullivan brings invaluable executive experience on a wide array of issues, including strategic planning and the evaluation and execution of acquisition opportunities. | |

John M. Timken, Jr. Age: 71 Director since 1986 Independent Chairman of the Board | Business Experience Mr. Timken is a private investor and a successful entrepreneur, who has been a significant shareholder of the Company for many years. Mr. Timken is co-founder of Amgraph Packaging, a national supplier of flexible package printing used by major food and beverage brands and private labels. His entrepreneurial activities and passion for business-building have included involvement in ventures ranging from injection molding, to ophthalmic laboratories, to logistics and trucking. He also has owned a cable television business and established one of the largest commercial mushroom farms in North America. Qualifications Mr. Timken’s ability as an investor to identify and help increase value across a range of industries, as well as his familiarity with the Company’s businesses, provides the Board with critical input in evaluating and making capital allocation decisions. Since joining the Board, he has played an important role in the Company’s strategic drive to add product lines that complement its bearing product portfolio. |

Ward J. Timken, Jr. Age: 55 Director since 2002 | Business Experience Mr. Timken co-founded McKinley Strategies, LLC, a political consulting firm, and has served as its Chief Executive Officer since January 2020. Prior to that, Mr. Timken served as Chairman, Chief Executive Officer and President of TimkenSteel, a leader in customized alloy steel products and services, from 2014 to 2019. TimkenSteel was previously a subsidiary of the Company that became an independent public company pursuant to a spinoff in 2014. Mr. Timken previously served as Executive Chairman of the Board of The Timken Company from 2005 to May 2014. Qualifications Mr. Timken provides the Board with relevant experience from having served in key leadership positions during his tenure with the Company. Mr. Timken’s broad-based experience and familiarity with our businesses, along with his understanding of the global industry dynamics across the Company’s markets, enable Mr. Timken to provide valuable input to the Board. |

Independence Determinations

The Board of Directors has adopted the NYSE independence standards for determining the independence of our Directors. The Board has also adopted standards for categorically immaterial relationships to assist the Board in determining the independence of each Director. These standards include, but are not limited to:

| ● | if the Director is, or has an immediate family member who is, a partner, principal or member (or any comparable position) of, an executive officer or employee of, or a director of, any organization to which Timken made, or from which Timken received, immaterial payments for property or services in the current or any of the past three fiscal years; | |

| ● | if the Director, or an immediate family member of the Director, serves as an officer, director or trustee of a foundation, university, charitable or other not-for-profit organization, and Timken’s discretionary charitable contributions to the organization are immaterial, in the aggregate; or | |

| ● | if the Director serves on the board of directors of another company at which another Timken Director or executive officer also serves as a director. |

A complete list and description of the categorically immaterial relationships is set forth in Appendix B to the Board of Directors General Policies and Procedures, which is available on the Corporate Governance Section of our website at https://investors.timken.com/corporate-governance/documents/.

The Board has determined that the following Director nominees meet these independence standards: Maria A. Crowe, Elizabeth A. Harrell, Sarah C. Lauber, John A. Luke, Jr., Christopher L. Mapes, James F. Palmer, Ajita G. Rajendra, Frank C. Sullivan, and John M. Timken, Jr. With respect to John M. Timken, Jr., the Board determined that his family relationship to Ward J. Timken, Jr. does not impair his independence. Jacqueline F. Woods, who will serve as a Director of the Company until the 2023 Annual Meeting of Shareholders, also has been determined to meet the Board’s independence standards. |

10/12 members of our current Board are independent

|

| 18 |

Related Party Transactions Approval Policy

Our Directors and executive officers are subject to our Standards of Business Ethics, which require that any potential conflicts of interest involving our Directors or executive officers, such as significant transactions with related parties, be reported to our Vice President, General Counsel & Secretary.

Our Directors and executive officers also are subject to the Timken Policy Against Conflicts of Interest, which requires that an employee or Director avoid placing himself or herself in a position in which his or her personal interests could interfere, or appear to interfere, with our interests. While not every situation can be identified in a written policy, the Timken Policy Against Conflicts of Interest identifies the following situations as examples that may constitute a prohibited conflict of interest:

| ● | competing against the Company; | |

| ● | holding a significant financial interest in a company doing business with or competing with the Company; | |

| ● | accepting gifts, gratuities or entertainment from any customer, competitor or supplier of goods or services to the Company, except to the extent they are customary and reasonable in amount and not in consideration for an improper action by the recipient; | |

| ● | using for personal gain any business opportunities that are identified through a person’s position with the Company; | |

| ● | using the Company’s property, information or position for personal gain; | |

| ● | using the Company’s property other than in connection with our business; | |

| ● | maintaining other employment or a business that adversely affects a person’s job performance at the Company; and | |

| ● | doing business on the Company’s behalf with a relative or another company employing or owned by a relative. |

In the event of any potential conflict of interest, pursuant to the charter of the Nominating and Corporate Governance Committee, the Standards of Business Ethics and the Timken Policy Against Conflicts of Interest, the Nominating and Corporate Governance Committee would review, determine whether or not a conflict of interest exists and, if appropriate after considering such factors as it deems appropriate under the circumstances, grant a waiver or specify any mitigation actions to address the potential conflict. Waivers involving our Directors or executive officers will be promptly disclosed to shareholders in a manner consistent with applicable laws or regulations and in accordance with our applicable policies. Additionally, the Nominating and Corporate Governance Committee would review and approve or ratify any transaction required to be publicly reported to shareholders pursuant to Item 404(a) of Regulation S-K of the Securities Exchange Act of 1934, as amended (the “1934 Act”), with such review to occur regardless of whether the materiality threshold of that provision is met.

Board and Committee Meetings

The Board of Directors has an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. During 2022, there were seven meetings of the Board of Directors, nine meetings of its Audit Committee, three meetings of its Compensation Committee and three meetings of its Nominating and Corporate Governance Committee. All Directors attended 75% or more of the meetings of the Board and its committees on which they served. It is our policy that all members of the Board of Directors attend the annual meeting of shareholders and, in 2022, all members attended the meeting. At each regularly scheduled meeting of the Board of Directors, the independent Directors have the opportunity to meet separately in executive session.

| 19 |

Board Leadership Structure

The Board is led by independent Chairman John M. Timken, Jr., who was first elected to this position on May 13, 2014.

The Chairman oversees the planning of the annual Board calendar and, with the CEO and in consultation with the other Directors, schedules and sets the agenda for meetings of the Board and leads the discussions at such meetings and at executive sessions of the independent Directors. The Chairman also leads the Company’s annual meeting of shareholders and performs such other functions and responsibilities as set forth in the Board of Directors General Policies and Procedures or as requested by the Board from time to time.

The Board’s preferred governance structure is to separate the roles of Chair and CEO. Since 2014, the Chair of the Board has been independent. While recognizing that there is no single, generally accepted approach to providing Board leadership and that the Board’s leadership structure may vary in the future as circumstances warrant, the Board considers this balance of leadership between the two positions to be beneficial.

Director Compensation

Directors who are not Timken employees receive an annual retainer fee, annual committee fees (as applicable) and an annual equity award. The independent Chairman and each committee chairperson receive additional retainer fees. Richard G. Kyle, our President and Chief Executive Officer (“CEO”), does not receive any additional compensation for his service as a Director.

Cash Compensation

Each nonemployee Director who served in 2022 was paid an annual retainer fee of $90,000 as base compensation for services as a Director (an increase of $10,000 over 2021). In addition to base compensation, John M. Timken, Jr. received an annual fee of $125,000 for his service as the independent Chairman (an increase of $25,000 over 2021). The following additional annual fees were paid for serving on a committee of the Board in 2022:

| Committee | Chairperson Fee | Member Fee |

| Audit | $35,000 | $15,000 |

| Compensation | $22,500 | $7,500 |

| Nominating & Corporate Governance | $19,500 | $7,500 |

For 2022, the chairperson fees for the Audit Committee and Compensation Committee were increased by $5,000 over 2021, and the chairperson fee for the Nominating & Corporate Governance Committee was increased by $2,000 over 2021.

Equity Compensation

Each nonemployee Director serving at the time of our 2022 Annual Meeting of Shareholders on May 6, 2022 received a grant of 2,310 restricted stock units (representing a targeted value of approximately $140,000, an increase of $20,000 over 2021) that vest after one year under The Timken Company 2019 Equity and Incentive Compensation Plan (the “Equity and Incentive Compensation Plan”). Cumulative dividend equivalents are paid in cash upon vesting.

| 20 |

Holding Requirement

The Compensation Committee of the Board of Directors has adopted stock ownership requirements for nonemployee Directors equal to five times the annual cash retainer of $90,000, or the equivalent of $450,000 worth of common shares. Directors must meet this requirement within five years of becoming a Director of the Company. In determining whether a Director has met his or her individual ownership target, the Company considers shares owned by the Director and full-value equity awards held by the Director, including restricted stock units still subject to vesting conditions. As of December 31, 2022, all our Directors other than Ms. Lauber had met their stock ownership requirements. Ms. Lauber joined the Board in January 2021 and she is on track to achieve the ownership requirement within the five-year time frame.

Compensation Deferral

Any Director may elect to defer the receipt of all or a specified portion of their cash fees or their annual equity award until a specified point in the future in accordance with the provisions of the Director Deferred Compensation Plan, as amended and restated effective January 1, 2015 (the “Director Deferred Compensation Plan”). The cash amounts deferred can be invested in a cash fund or the hypothetical Timken common share fund. The cash fund provides for interest to be earned quarterly at a rate equal to the prime rate plus 1%. If cash fees are invested in the Timken common share fund, Directors may elect to receive cash in an amount equal to any dividend equivalents or reinvest such amounts in the Timken common share fund. Equity award deferrals are maintained in a separate account, which is credited with the number of shares that would otherwise have been issued or transferred and delivered to the Director. Such accounts are credited from time to time with amounts equal to dividends or other distributions paid on the number of shares reflected in such accounts.

2022 Director Compensation Table

The following table provides the compensation and benefits applicable to our nonemployee Directors for 2022:

| Name (1) | Fees Earned or Paid in Cash | Stock Awards (2) | All Other Compensation (3) | Total | |||||

| Maria A. Crowe | $124,500 | $140,286 | $1,608 | $266,394 | |||||

| Elizabeth A. Harrell | $105,000 | $140,286 | $1,852 | $247,138 | |||||

| Sarah C. Lauber | $112,500 | $140,286 | $2,084 | $254,870 | |||||

| John A. Luke, Jr. | $105,000 | $140,286 | $1,608 | $246,894 | |||||

| Christopher L. Mapes | $112,500 | $140,286 | $1,608 | $254,394 | |||||

| James F. Palmer | $132,500 | $140,286 | $1,608 | $274,394 | |||||

| Ajita G. Rajendra | $127,500 | $140,286 | $1,608 | $269,394 | |||||

| Frank C. Sullivan | $112,500 | $140,286 | $1,608 | $254,394 | |||||

| John M. Timken, Jr. | $215,000 | $140,286 | $1,608 | $356,894 | |||||

| Ward J. Timken, Jr. | $90,000 | $140,286 | $1,608 | $231,894 | |||||

| Jacqueline F. Woods | $105,000 | $140,286 | $1,608 | $246,894 |

| (1) | Richard G. Kyle, our President and CEO, is not included in this table as he is an employee of the Company and receives no additional compensation for his services as a Director. | |

| (2) | The amount shown for each Director includes the grant date fair value of the award of 2,310 restricted stock units made on May 6, 2022. These restricted stock units vest 100% one year following the grant date. Ms. Harrell elected to defer the award made on May 6, 2022 under the Director Deferred Compensation Plan for distribution in the future. The amounts shown in this |

| column are computed in accordance with Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 718. | ||

| (3) | All other compensation reflects cash dividend equivalents paid to the Directors in 2022 for unvested restricted stock units granted in the prior year and cash dividends paid to certain Directors for unvested restricted shares or restricted stock units granted in connection with their initial election to the Board, in each case upon vesting of such restricted stock units or restricted shares in 2022. Ms. Harrell elected to defer her annual restricted stock unit award granted in 2022 under the Director Deferred Compensation Plan for distribution in the future. The table above includes cash dividend equivalents in the amount of $1,608 which were also deferred by Ms. Harrell under the Director Deferred Compensation Plan. |

As of December 31, 2022, unvested restricted stock units were held by the nonemployee Directors as follows:

| Name | Unvested Restricted Stock Units | ||

| Maria A. Crowe | 2,310 | ||

| Elizabeth A. Harrell | 2,310 | ||

| Sarah C. Lauber | 3,910 | ||

| John A. Luke, Jr. | 2,310 | ||

| Christopher L. Mapes | 2,310 | ||

| James F. Palmer | 2,310 | ||

| Ajita G. Rajendra | 2,310 | ||

| Frank C. Sullivan | 2,310 | ||

| John M. Timken, Jr. | 2,310 | ||

| Ward J. Timken, Jr. | 2,310 | ||

| Jacqueline F. Woods | 2,310 |

Board Committees

Audit Committee

We have a standing Audit Committee that has oversight responsibility with respect to our independent auditor and the integrity of our financial statements. Current members of the Audit Committee are James F. Palmer (Audit Committee Chair), Maria A. Crowe, Sarah C. Lauber, Christopher L. Mapes and Ajita G. Rajendra. As part of ordinary course committee assignment rotation, Frank C. Sullivan rotated from our Audit Committee to our Compensation Committee, effective as of February 10, 2023. Our Board of Directors has determined that each member of the Audit Committee is financially literate and independent as defined in the listing standards of the NYSE and the rules of the Securities and Exchange Commission (the “SEC”). Our Board of Directors has determined that Sarah C. Lauber and James F. Palmer qualify as Audit Committee financial experts.

The Audit Committee’s charter is available on the Corporate Governance section of our website at https://investors.timken.com/corporate-governance/documents/.

Compensation Committee

We have a standing Compensation Committee that establishes and administers our policies, programs and procedures for compensating our senior management and Board of Directors. Current members of the Compensation Committee are Ajita G. Rajendra (Compensation Committee Chair), Elizabeth A. Harrell, Sarah C. Lauber, John A. Luke, Jr., James F. Palmer, Frank C. Sullivan and Jacqueline F. Woods.

| 22 |

Our Board of Directors has determined that all members of the Compensation Committee are independent as defined in the listing standards of the NYSE.

With the guidance and approval of the Compensation Committee, we have developed compensation programs for our executive officers, including the CEO and the other named executive officers, that are intended to align the interests of our executives and shareholders; reward executive management for sustained, strong business and financial results; and enable us to attract, retain and motivate the best talent. The Compensation Committee determines specific compensation elements for the CEO and considers and acts upon the CEO’s recommendations regarding the other executive officers.

The agenda for meetings of the Compensation Committee is determined by its Chair with the assistance of the General Manager – Compensation. The meetings are regularly attended by the Chairman of the Board, the CEO, the Vice President, General Counsel & Secretary, the Vice President –Human Resources, and the General Manager – Compensation. At each meeting, the Compensation Committee meets in executive session. The Chair of the Compensation Committee reports the Committee’s actions regarding compensation of executive officers to the full Board and the full Board acts on compensation matters for the CEO.

Our Human Resources department supports the Compensation Committee in its duties and may be delegated certain administrative duties in connection with our compensation programs. The Compensation Committee has the sole authority to retain and terminate compensation consultants to assist in the evaluation of Director and executive officer compensation and the sole authority to approve the fees and other retention terms of any compensation consultants. The Compensation Committee has engaged Willis Towers Watson Public Limited Company (“WTW”), a global professional services firm, to conduct annual reviews of its compensation programs for the Company’s executive officers and Directors. WTW also provides information to the Compensation Committee on trends in executive compensation and other market data. WTW (or its predecessor) has provided executive consulting services to the Compensation Committee and other professional consulting services to the Company for over 20 years.

With respect to Director compensation, as stated above, the Compensation Committee annually engages WTW to conduct reviews of Director compensation, and the Committee may then recommend to the full Board changes in Director compensation that will enhance our ability to attract and retain qualified Directors.

During fiscal year 2022, WTW was paid approximately $270,000 for the executive and Director compensation consulting services it provided to the Compensation Committee. Other professional consulting services provided by WTW to the Company, which were requested by management, not approved by the Compensation Committee or the Board and not related to executive compensation, totaled approximately $2.2 million, most of which (greater than $2.0 million) related to retirement consulting and outsourcing of pension administration services.

The Compensation Committee has concluded that the advice it receives from WTW continues to be objective, unbiased and independent. The Compensation Committee’s careful oversight of the relationship with WTW with respect to compensation advice mitigates the risk that management potentially could misuse the actuarial engagement to influence WTW’s compensation work for the Compensation Committee. The Compensation Committee annually reviews the charges to the Company from WTW for executive and Director compensation advice and other services for the preceding three years, along with an estimate of services for the coming year. Additionally, WTW has adopted internal safeguards to ensure that its executive compensation unit is maintained separately from its actuarial business.

The Compensation Committee has assessed the independence of WTW, as required under the listing standards of the NYSE. The Compensation Committee also has considered and assessed relevant factors that could give rise to a potential conflict of interest with respect to WTW, specifically including the six consultant independence factors under Rule 10C-1(b)(4)(i) through (vi) under the 1934 Act. Based on this review, we are not aware of any conflict of interest regarding the work performed by WTW.

| 23 |

The Compensation Committee also plays an active role in our executive officer succession planning process. The Compensation Committee meets regularly with senior management to ensure that an effective succession planning process is in place and to discuss potential successors for executive officers. As part of this process, executive officer position profiles are updated to highlight the key skills required to meet future demands, and potential successors are evaluated and development plans are reviewed. Each year, the Compensation Committee reviews and discusses potential successors for each of the executive officers with the full Board in executive session. In addition, at the end of each year, the Compensation Committee reviews the performance of each of the executive officers. The Compensation Committee is also periodically updated regarding more broad-based human capital focused initiatives such as pay equity studies and, alongside the remainder of the Board, employee engagement surveys.

The Compensation Committee’s charter is available on the Corporate Governance section of our website at https://investors.timken.com/corporate-governance/documents/. For more information regarding the role of management and the compensation consultants in determining or recommending the amount or form of executive compensation, see “Compensation Discussion and Analysis –Determining Compensation for 2022” on page 44.

Nominating and Corporate Governance Committee

We have a standing Nominating and Corporate Governance Committee that is responsible for, among other things, evaluating new Director candidates and incumbent Directors, recommending Directors to serve as members of our Board committees, and providing oversight of the Company’s CSR program. Current members of the Nominating and Corporate Governance Committee are Maria A. Crowe (Nominating and Corporate Governance Committee Chair), Elizabeth A. Harrell, John A. Luke, Jr., Christopher L. Mapes, Frank C. Sullivan and Jacqueline F. Woods. Our Board of Directors has determined that all members of the Nominating and Corporate Governance Committee are independent as defined in the listing standards of the NYSE.

The Board of Directors General Policies and Procedures provide that the general criteria for Director candidates include, but are not limited to, the highest standards of integrity and ethical behavior, the ability to provide wise and informed guidance to management, a willingness to pursue thoughtful, objective inquiry on important issues before the Company and a range of experience and knowledge commensurate with our needs as well as the expectations of knowledgeable investors.

The Nominating and Corporate Governance Committee utilizes a variety of sources to identify possible Director candidates, including search firms, professional associations and Director recommendations. In evaluating candidates to recommend to the Board of Directors, the Nominating and Corporate Governance Committee considers factors consistent with those set forth in the Board of Directors General Policies and Procedures, including whether the candidate enhances the diversity of the Board. Such diversity includes professional background and capabilities, knowledge of specific industries and geographic experience, as well as the more traditional diversity concepts of race, gender and national origin. The attributes of the current Directors and the needs of the Board and the Company are evaluated whenever a Board vacancy occurs, and the effectiveness of the nomination process, including whether that process enhances the Board’s diversity, is evaluated each time a candidate is considered. The Nominating and Corporate Governance Committee also is responsible for reviewing the qualifications of, and making recommendations to the Board of Directors for, Director nominations submitted by our shareholders. All Director nominees are evaluated in the same manner by the Nominating and Corporate Governance Committee, without regard to the source of the nominee recommendation.

The Nominating and Corporate Governance Committee also plans for Director succession. The Committee regularly reviews the size of the Board and whether any vacancies are expected due to retirement, refreshment or otherwise. The Nominating and Corporate Governance Committee seeks to maintain an appropriate mix of newer Directors who bring fresh perspectives with longer-tenured Directors who have deep knowledge of our global operations and long-term strategy. In the event that vacancies are anticipated or otherwise arise, the Committee considers potential Director candidates in accordance with the factors and criteria outlined above.

| 24 |

The Nominating and Corporate Governance Committee’s charter is available on the Corporate Governance section of our website at https://investors.timken.com/corporate-governance/documents/.

Our code of business conduct and ethics, called the “Standards of Business Ethics,” and our corporate governance guidelines, called the “Board of Directors General Policies and Procedures,” are reviewed by the Nominating and Corporate Governance Committee as appropriate and are available on the Corporate Governance section of our website at https://investors.timken.com/corporate-governance/documents/.

Shareholder-Recommended Director Candidates

Director candidates recommended by our shareholders will be considered by the Nominating and Corporate Governance Committee in accordance with the criteria outlined above. In order for a shareholder to submit a recommendation, the shareholder must deliver a communication by registered mail or in person to the Nominating and Corporate Governance Committee, c/o The Timken Company, 4500 Mt. Pleasant Street NW, North Canton, Ohio 44720. Such communication should include the proposed candidate’s qualifications, any relationship between the shareholder and the proposed candidate, and any other information that the shareholder considers useful for the Nominating and Corporate Governance Committee to consider in evaluating such candidate.

Shareholder-Nominated Director Candidates

Our Amended Regulations provide a “proxy access” right to permit any shareholder or a group of up to 20 shareholders owning 3% or more of the voting power entitled to vote in the election of Directors continuously for at least three years to nominate and include in our proxy materials Director nominees for election to the Board. A shareholder or shareholders, as applicable, can nominate up to the greater of (i) 20% of the total number of Directors on the Board, rounding down to the nearest whole number, and (ii) two Directors in accordance with the requirements set forth in our Amended Regulations. Under our Amended Regulations, requests to include shareholder-nominated candidates for Director in our proxy materials must be received no earlier than 150 days and no later than 120 days before the anniversary of the date that we issued our Proxy Statement for the previous year’s annual meeting of shareholders. Requests to include shareholder-nominated candidates for Director in our proxy materials related to the 2024 Annual Meeting of Shareholders must be delivered by certified mail, return receipt requested, to our Vice President, General Counsel & Secretary, c/o The Timken Company, 4500 Mt. Pleasant Street NW, North Canton, Ohio 44720, no earlier than October 22, 2023 and no later than November 21, 2023 in order to be timely. The summary of this “proxy access” right set forth above is qualified in its entirety by our Amended Regulations.

Corporate Governance and Social Responsibility Highlights

The Nominating and Corporate Governance Committee regularly reviews trends and recommends best practices, initiates improvements, and plays a leadership role in maintaining the Company’s strong corporate governance structure and practices. The below table details the practices the Nominating and Corporate Governance Committee believes demonstrate the Company’s commitment to strong corporate governance and additional information about the Company’s corporate governance structure and practices can be found in the Board of Directors General Policies and Procedures, our Amended Regulations and our Amended Articles of Incorporation.

| 25 |

| Board Independence, Refreshment, Diversity and Experience | |

| ü | Strongly independent Board (10 of 12 Directors on our current Board are independent) |

| ü | Independent Chairman of the Board |

| ü | Commitment to Board refreshment and diversity – 6 new Directors (representing half of our current Board) added in the past decade |

| ü | 5 of 12 current Directors and 2 of 3 committee chairs are ethnically or gender diverse |

| ü | 6 current or former public company Chief Executive Officers serve on the Board |

| Shareholder Rights | |

| ü | Shareholder proxy access with 3/3/20/20 parameters |

| ü | Special meetings may be called by shareholders holding 25% of the Company’s common shares |

| Other Strong Governance Practices | |

| ü | Declassified Board – all Directors are elected annually |

| ü | Annual Board, Committee and Director evaluations |

| ü | Majority Voting Policy that requires any Director who fails to receive a majority of the votes cast in favor of his or her election to submit his or her resignation to the Board |

| ü | Over-boarding policy limits the number of public company boards a Director can serve on |

| ü | “Clawback” provisions permit recovery of executive compensation if an executive engages in conduct that is detrimental to the Company and that results in restatement of financial results |

| ü | Stock ownership requirements for Directors and executive officers |

| ü | Audit Committee or Board receives reports on cyber security threats and trends at least annually and receives regular updates on our information security program |

| ü | Strong focus on shareholder engagement – over 400 interactions with investors in 2022 |

The Nominating and Corporate Governance Committee also provides oversight of our CSR program, though the full Board of Directors as well as its other standing committees also play a role in advising on certain CSR-related topics such as human capital initiatives and risk oversight.

Oversight and Management of the Company’s CSR Program

| 26 |

In 2022, we continued to expand upon our CSR program and further detailed our efforts to support our stakeholders as a socially responsible corporation. Our CSR program is guided by our core values of ethics and integrity, quality, teamwork and excellence. In line with our engineering culture, we view CSR as a system of actions to improve the lives of individuals and communities, benefit the planet, and strengthen our business. We have organized our CSR reporting efforts into four key focus areas as set forth below.

| Focus Area | People | Environment | Community | Governance |

| Certain Key Topics | Learning and Development; | Product Sustainability; | STEM and Mentorship; | Ethics and Corporate Governance; |

| Initiatives | ● Enhancing diversity and inclusion initiatives to encourage global, diverse viewpoints ● Deploying comprehensive employee surveys to inform efforts that increase associate engagement and satisfaction ● Rewarding associates with strong wages and competitive benefits to recognize professional excellence and career progression ● Investing in associate education, training and development programs to support a culture of learning | ● Embracing energy efficiency, pollution prevention, waste management and recycling programs at Timken global facilities to reduce our environmental footprint ● Establishing emissions reduction targets ● Engineering innovative products that increase the energy efficiency of machinery and equipment and propel the renewable energy sector ● Continuously improving our world-class safety programs to protect associate health and safety | ● Building and investing in communities where we live and work through volunteerism ● Maintaining an effective associate and corporate-led charitable giving program ● Partnering with charitable organizations driving positive impacts in the communities in which we operate | ● Upholding strong corporate governance principles and practices to promote the interests of the Company and its stakeholders ● Leading with and living our values every day, while operating ethically and responsibly in accordance with our Standards of Business Ethics ● Promoting and protecting recognized human rights in our local communities |

| CSR Report Highlights | |

| People | We remain focused on advancing the diversity and education of our global workforce through our hiring practices, succession planning, training and development programs, and inclusive culture. Examples of regular, formal training and development activities include: • Our Operations Development Program, which is designed to increase the internal pool of people who are ready to take on leadership roles at Timken; • Our Associate Sales Engineer Training Program, which helps new engineering graduates gain a complete understanding of friction management and power transmission concepts; • Our Timken Engineering Co-Op Program, which gives engineering students with diverse backgrounds the opportunity to work up to five semesters alongside our experienced engineers while completing their bachelor’s degrees; and • Our Inclusive Leader Program, which is designed to deliver real-world impact through associate listening, feedback, mutual learning, adaptability and collaboration. The program is focused on increasing our global managers’ understanding of the day-to-day impacts of their own cultural tendencies, style and biases at work. It’s also designed to drive inclusion by providing our leaders with tools to increase and leverage the diversity that surrounds them. We are also committed to providing competitive and equitable compensation based on the local markets in which we operate while supporting employee health. We conduct market studies around the world to ensure full-time associates receive competitive benefits relative to the markets where they work. |

| Environment | We continue to pursue greater sustainability across our product portfolio through product design, lifetime performance improvements, and the use of recyclable content. We also set new emissions reduction targets in 2022. Since 2020, renewable energy has been our single largest end-market sector in terms of total sales. The Company’s products, technology and innovation continue to support the global trend towards sustainability and meet customers’ evolving requirements for optimized reliability and performance. |

| Community | We continue to further equal access to basic needs, education and STEM careers though strategic partnerships with United Way, Feeding America, Habitat for Humanity, American Red Cross, NASA, LeBron James Foundation, Maison pour la Science and others. |

| Governance | We provided detail on the features of our ethics and compliance program, including how we maintain active board oversight, support compliance, and educate our employees. We also provided examples of our ongoing efforts to keep our data secure through our enterprise-wide information security program. |

In consideration of our efforts, we were named one of America’s Most Responsible Companies by Newsweek and Statista for the second time. Other recent awards include:

| ● | Forbes: America’s Best Employers (2021), Best Employers for New Graduates (2021 and 2022) and Best Employers for Women (2021); and | |

| ● | The Ethisphere Institute: World’s Most Ethical Companies® (2021 and awarded 11 times total). |

For more information regarding our corporate social responsibility program, please see our most recent corporate social responsibility report available on our website at https://www.timken.com/corporate-social-responsibility/.

| 28 |

Shareholder Engagement in 2022

Risk Oversight

The Board of Directors primarily relies on its Audit Committee for oversight of the Company’s risk management. The Audit Committee regularly reviews issues that present particular risks to the Company, including those involving competition; economic and geopolitical conditions; planning and strategy; finance; sales and marketing; product technology and innovation; information technology and cybersecurity; facilities, operations and supply chain; environmental, health and safety; product warranty; talent management; litigation; compliance; and other matters. The full Board and other Committees also review certain of these issues as appropriate. The Board believes that this approach, supported by our leadership structure, provides appropriate checks and balances against undue risk taking.

Shareholder Communications

Shareholders or interested parties may send communications to the Board of Directors, to any standing committee of the Board, or to any Director, in writing c/o The Timken Company, 4500 Mt. Pleasant Street NW, North Canton, Ohio 44720. Shareholders or interested parties also may submit questions, concerns or reports of misconduct through the Timken Helpline at 1-800-846-5363 and may remain anonymous. Such communications may be reviewed by the office of the Vice President, General Counsel & Secretary to ensure appropriate and careful review of the matter.

| 29 |

BENEFICIAL OWNERSHIP OF COMMON SHARES

The following table shows, as of January 1, 2023, the beneficial ownership of our common shares by each Director, nominee for Director and executive officer named in the 2022 Summary Compensation Table on page 58 of this Proxy Statement, and by all Directors, nominees for Director and executive officers as a group. Beneficial ownership of our common shares has been determined for this purpose in accordance with Rule 13d-3 under the 1934 Act and is based on the sole or shared power to vote or direct the voting or to dispose or direct the disposition of our common shares. Beneficial ownership as determined in this manner does not necessarily bear on the economic incidents of ownership of our common shares.

| Amount and Nature of Beneficial Ownership of common shares | ||||||||||||||||

| Name (1) | Sole Voting or Investment Power (2) | Shared Voting or Investment Power | Aggregate Amount (2) | Percent of Class | ||||||||||||

| Christopher A. Coughlin | 285,454 | 0 | 285,454 | * | ||||||||||||

| Maria A. Crowe | 21,851 | 0 | 21,851 | * | ||||||||||||

| Philip D. Fracassa | 127,871 | 0 | 127,871 | * | ||||||||||||

| Elizabeth A. Harrell | 11,945 | 0 | 11,945 | * | ||||||||||||

| Richard G. Kyle | 656,280 | 0 | 656,280 | * | ||||||||||||

| Sarah C. Lauber | 2,140 | 0 | 2,140 | * | ||||||||||||

| John A. Luke, Jr. | 70,545 | 0 | 70,545 | * | ||||||||||||

| Christopher L. Mapes | 22,500 | 0 | 22,500 | * | ||||||||||||

| James F. Palmer | 17,545 | 0 | 17,545 | * | ||||||||||||

| Hansal N. Patel | 10,469 | 0 | 10,469 | * | ||||||||||||

| Ajita G. Rajendra | 20,590 | 0 | 20,590 | * | ||||||||||||

| Andreas Roellgen | 86,533 | 0 | 86,533 | * | ||||||||||||

| Frank C. Sullivan | 61,382 | 0 | 61,382 | * | ||||||||||||

| John M. Timken, Jr. | 458,825 | (3) | 915,427 | (4) | 1,374,252 | 1.89 | % | |||||||||

| Ward J. Timken, Jr. | 520,051 | 3,864,031 | 4,384,082 | 6.04 | % | |||||||||||

| Jacqueline F. Woods | 14,770 | 0 | 14,770 | * | ||||||||||||

| All Directors, nominees for Director and executive officers as a group(5) | 2,395,273 | 4,782,655 | 7,177,928 | 9.89 | % | |||||||||||

* Percent of class is less than 1%.

| 30 |

| (1) | Excludes Mr. Landin due to his separation from the Company on August 1, 2022. At the time of his departure, Mr. Landin possessed sole voting or investment power over 29,826 common shares. | |

| (2) | The following table provides additional details regarding beneficial ownership of our common shares: |

| Name | Outstanding Options and Time- based Restricted Stock Units (a) | Deferred Common Shares (b) | ||

| Christopher A. Coughlin | 180,333 | 0 | ||

| Maria A. Crowe | 0 | 0 | ||

| Philip D. Fracassa | 42,212 | 0 | ||

| Elizabeth A. Harrell | 0 | 6,925 | ||

| Richard G. Kyle | 316,437 | 0 | ||